Fako Capital is the first Central Africa impact investment fund based in Cameroon, dedicated to financing and supporting SMEs and start-ups with high growth potential and financial, social and environmental benefits.

Support SMEs in their transformation, to make them the uncontested leaders in their business sectors in Cameroon and Central Africa

Financing and supporting entrepreneurs to enable them to realize their full potential and stimulate value creation, while fostering their contribution to economic resilience and social commitment

Entrepreneurial spirit, commitment to development, integrity, commitment to excellence

Fako Capital works primarily with entrepreneurs based in Cameroon initially, and in Central Africa later, as well as with local suppliers and service providers to develop a dynamic fabric of SMEs in the sub-region.

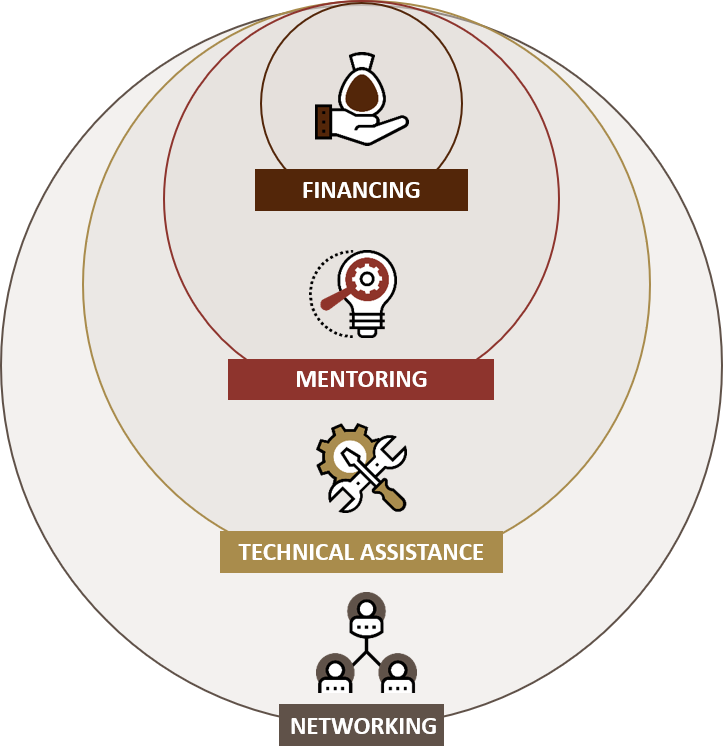

Alongside the entrepreneur, we build a strategy and put in place an organizational and operational structure to accelerate business development, the creation of formal jobs for young people and the economic and social inclusion of women. Our approach is organized around the entrepreneur, with whom we aim to build a long-term relationship of trust.

By focusing our efforts on these areas, we aim to catalyze a sustainable impact, both economically and socially, thereby contributing to the dynamic and inclusive development of Cameroon and the Central African region.

Aware of the social and environmental challenges, as well as the difficulties of access to finance for entrepreneurs, particularly women and young people, we are committed to integrating Environmental, Social and Governance (ESG) considerations at every stage of our investment and divestment process, and are committed to contributing very actively to the achievement of the Sustainable Development Goals (SDGs).

At Fako Capital, we are committed to generating a positive, sustainable and measurable social & environmental impact in local communities, and to ensuring that at least 80% of our portfolio companies meet the criteria for gender-based investment. We promote job creation and formalization within the SMEs we support, gender diversity and parity within our team and senior management – as well as within the SMEs in our portfolio, and the support and promotion of youth entrepreneurship.